FinNifty Max Pain: A Guide to Smarter Trading

When it comes to options trading, understanding key concepts like FinNifty max pain can make a huge difference in how you approach your strategies. If you’re new to this topic or looking for a clear explanation, you’ve come to the right place. This guide will explain everything about FinNifty max pain in simple terms and show you how it can help you become a smarter trader.

What is FinNifty?

Before diving into FinNifty max pain, let’s understand what FinNifty is. FinNifty is an index developed by NSE (National Stock Exchange) that tracks the performance of key financial sector companies in India. It includes banks, insurance firms, and other financial services companies. This index is widely used for options and futures trading.

If you’re curious about the basics of indices and how they’re calculated, the Wikipedia page on stock market indices can be a helpful resource.

What is Max Pain in Options Trading?

Max pain is a term used in options trading to describe the price level at which option holders (buyers) experience the most loss, and option sellers (writers) gain the most. It’s based on the idea that most options expire worthless, and the market often moves toward this price level as the expiry date approaches.

In simple words, max pain is the strike price where the most options contracts—calls and puts combined—lose value. Traders use this concept to predict potential price movements as expiry nears.

If you want to read more about the concept, the Investopedia page on Max Pain is a great resource.

What is FinNifty Max Pain?

Now, let’s focus on FinNifty max pain. This refers to the max pain price level specifically for the FinNifty index. Traders use it to anticipate where the FinNifty index might close on the expiry day of options contracts.

Why is FinNifty Max Pain Important?

- Predict Market Behavior: It helps traders gauge potential market movement as the expiry date approaches.

- Plan Trading Strategies: Knowing the max pain level allows traders to adjust their positions to reduce losses or maximize profits.

- Understand Market Sentiment: It reflects the collective sentiment of options traders.

How to Calculate FinNifty Max Pain?

The calculation of FinNifty max pain involves:

- Listing all open interest for call and put options at different strike prices.

- Calculating the total loss at each strike price.

- Identifying the strike price with the least total loss for all option sellers.

Many trading platforms and websites provide ready-made tools for calculating max pain, so you don’t have to do it manually.

How to Use FinNifty Max Pain in Trading?

Plan Entry and Exit

By observing the FinNifty max pain level, you can determine entry and exit points for your trades. For instance, if the index is close to the max pain level, it may stay around that range until expiry.

Avoid Emotional Decisions

Having a clear understanding of the max pain concept helps you make data-driven decisions rather than acting on impulses.

Identify Market Manipulation

Max pain levels can sometimes indicate market manipulation by institutional players. Staying aware of this can help you avoid falling into traps.

Example of FinNifty Max Pain in Action

Suppose FinNifty is trading at 20,000, and the max pain level is calculated at 19,800. As expiry approaches, you may notice the index drifting toward 19,800. This doesn’t guarantee the exact outcome but provides a probable range for better planning.

Tips for Using FinNifty Max Pain

- Use it as one of many tools in your trading strategy.

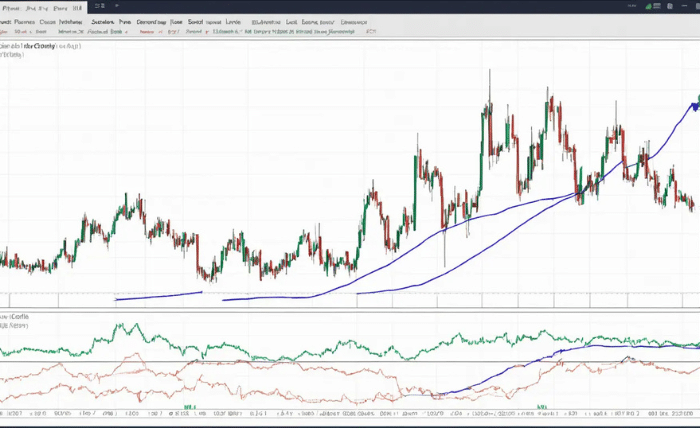

- Combine it with technical analysis and market trends.

- Avoid over-relying on it, as the market can be unpredictable.

Limitations of Max Pain

While FinNifty max pain is a helpful tool, it’s not foolproof. Factors like unexpected news, economic events, or large trades by institutional investors can impact market movement in unpredictable ways. Always use max pain in combination with other trading strategies.

Relevant Resources

To deepen your understanding of options trading and FinNifty, you can explore the following:

- Options Trading Basics

- National Stock Exchange (NSE) Official Website

(For FinNifty data and updates) - Stock Market Indices on Wikipedia

Final Thoughts

Understanding FinNifty max pain is an essential part of becoming a smarter trader. While it’s not a magic formula, it provides valuable insights into market trends and potential price movements. By using it wisely and combining it with other strategies, you can improve your trading decisions and manage risks effectively.

If you’re just starting, take time to learn and practice. Remember, patience and consistent learning are key to success in trading.