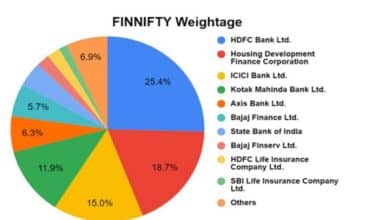

FinNifty, a financial index that focuses exclusively on the Nifty Financial Services sector, is essential for traders and investors focusing on financial services stocks in India. The importance of FinNifty live tracking cannot be overstated, as it provides real-time data and insights into how financial stocks are performing. By following FinNifty live, traders can make well-informed decisions that reflect the dynamic nature of the market.

FinNifty live tracking involves analyzing minute-by-minute fluctuations, which helps in understanding the short-term and long-term trends. This index includes leading financial services stocks, providing a unique lens into India’s financial sector, offering insights into banking, insurance, and non-banking financial institutions. For investors in financial services, FinNifty live updates are crucial in maximizing opportunities and minimizing risks in a volatile market.

How to Access FinNifty Live: Best Platforms and Tools

Tracking FinNifty live data requires access to reliable platforms and tools that offer real-time information. With an array of platforms available, choosing the right one can significantly influence the quality of data and the speed at which you receive updates. Popular platforms include NSE India, TradingView, and several brokerage apps that provide FinNifty live updates as part of their offerings.

For real-time trading, using platforms like Zerodha, Upstox, or Sharekhan can be beneficial, as they provide FinNifty live data along with technical analysis tools. Additionally, these platforms allow traders to set up alerts, customize dashboards, and access historical data for better decision-making. These tools can cater to both beginners and advanced traders, giving you the flexibility to tailor your setup for a seamless FinNifty live experience.

Benefits of Tracking FinNifty Live for Day Traders

Day traders rely heavily on FinNifty live updates to make rapid, data-driven decisions. Tracking FinNifty live provides day traders with immediate access to stock movement, which is vital when aiming to buy or sell at the perfect moment. Real-time insights can reveal sudden price changes, offering traders the opportunity to capitalize on short-term gains in a highly volatile environment.

Additionally, FinNifty live tracking helps day traders spot patterns and trends. By observing the performance of FinNifty live, traders can identify momentum shifts that might indicate a reversal or breakout. This information can assist in formulating entry and exit points for trades. FinNifty’s focus on the financial sector means that its performance is often aligned with economic policies and central bank announcements, making it essential to stay updated in real time.

Analyzing FinNifty Live Data: Key Indicators and Metrics to Watch

Understanding FinNifty live data is not just about looking at prices; it involves analyzing various indicators and metrics that provide context to the movements. Volume, moving averages, Relative Strength Index (RSI), and Bollinger Bands are some of the key indicators that traders monitor while tracking FinNifty live. These indicators help identify whether the market is experiencing bullish or bearish momentum.

Volume analysis, for example, is particularly crucial in FinNifty live tracking. High volumes may suggest strong buying or selling interest, providing a clue about potential price movements. Moving averages can show trends over time, while RSI indicates whether the FinNifty index is overbought or oversold. By understanding these metrics, traders can make more calculated decisions, enhancing the efficacy of their trades.

Real-Time Trading Strategies for FinNifty Live

Having effective trading strategies is vital for anyone following FinNifty live updates. One popular strategy is intraday trading, where traders enter and exit positions within the same day based on FinNifty’s movements. This strategy requires an acute understanding of FinNifty live data and a quick decision-making process, as price changes can be rapid and unpredictable.

Another strategy involves swing trading, where positions are held for a few days, capitalizing on medium-term trends observed in FinNifty live data. Traders might also employ scalping, which involves taking advantage of small price changes by making multiple trades throughout the day. Each of these strategies requires a keen eye on FinNifty live updates to identify optimal entry and exit points, enhancing profitability.

The Role of Economic Events in FinNifty Live Movements

Economic events play a significant role in the fluctuations observed in FinNifty live data. Events such as RBI announcements, government policies, and global economic developments can impact the financial sector, causing the FinNifty index to react accordingly. For instance, an interest rate hike by the RBI could potentially impact banking stocks, which are heavily represented in FinNifty.

Keeping track of scheduled economic events while monitoring FinNifty live helps traders anticipate market reactions. Traders often use economic calendars to keep an eye on events that may cause significant price changes. By correlating these events with FinNifty live data, traders can forecast possible trends and adjust their strategies to accommodate anticipated movements.

Common Mistakes to Avoid While Tracking FinNifty Live

While tracking FinNifty live data is beneficial, it’s also easy to make mistakes that can negatively impact trading outcomes. One common mistake is relying solely on FinNifty live price changes without considering broader market conditions. Not aligning FinNifty movements with market sentiment can result in misguided trading decisions.

Another mistake is ignoring technical indicators and focusing solely on price changes. Indicators such as RSI and MACD provide essential context to FinNifty live updates and are crucial in understanding market momentum. Overtrading is another pitfall, where traders make frequent trades based on minor fluctuations in FinNifty live data, leading to potential losses. Avoiding these mistakes can enhance the effectiveness of FinNifty live tracking and improve overall trading results.

Using FinNifty Live Data for Long-Term Investment Decisions

Although FinNifty live data is commonly used by day traders, it can also benefit long-term investors. By observing the live trends of FinNifty, long-term investors can identify favorable entry points or understand broader sectoral trends that impact the financial services industry. Analyzing FinNifty live movements over time allows investors to see the broader picture and make informed decisions.

For long-term investors, FinNifty live data can indicate overall economic health as well. Since FinNifty is heavily influenced by banking and financial stocks, it often reflects economic trends that long-term investors can leverage for strategic planning. By using FinNifty live data, investors can enhance portfolio diversification and mitigate risks related to economic shifts.

FinNifty Live Alerts: How to Set Up Notifications for Real-Time Updates

Setting up FinNifty live alerts can streamline the tracking process, ensuring that you don’t miss any critical changes. Most trading platforms offer alerts for FinNifty live updates, enabling you to receive notifications for price changes, volume shifts, and other key indicators. Alerts can be customized based on specific criteria that align with your trading or investment strategy.

For instance, setting an alert for a particular price level in FinNifty can notify you when it reaches your desired entry or exit point. Customizing these alerts ensures that you are always informed of crucial movements without having to monitor FinNifty live data constantly. Using alerts effectively allows traders to react promptly, making them invaluable tools in today’s fast-paced market.

Conclusion

Tracking FinNifty live provides an edge in understanding the real-time dynamics of the financial services sector, helping both day traders and long-term investors make informed decisions. By analyzing FinNifty live data through reliable platforms, using indicators, and implementing effective strategies, traders can navigate market volatility with greater precision.

From setting up real-time alerts to avoiding common mistakes, mastering FinNifty live tracking enhances your trading experience, helping you capitalize on profitable opportunities while mitigating risks. Understanding FinNifty live involves a combination of technical analysis, awareness of economic events, and strategic trading, all of which contribute to a successful trading journey.

FAQs

Q1: What platforms are best for tracking FinNifty live?

A: NSE India, TradingView, and brokerage apps like Zerodha and Upstox are popular platforms that offer reliable FinNifty live data.

Q2: Is FinNifty live tracking suitable for long-term investors?

A: Yes, long-term investors can benefit from FinNifty live tracking by identifying trends and favorable entry points for financial stocks.

Q3: What indicators are most useful in FinNifty live analysis?

A: Indicators like volume, RSI, moving averages, and Bollinger Bands are essential for understanding FinNifty live data and market momentum.

Q4: Can I set up alerts for FinNifty live updates?

A: Yes, many platforms allow custom alerts for price changes, volume shifts, and other criteria, helping you stay informed of key FinNifty movements.

Q5: How do economic events impact FinNifty live?

A: Economic events such as RBI announcements and global developments can significantly affect FinNifty, causing price fluctuations in the financial sector.