Finnifty Price: A Complete Guide for Traders and Investors

Introduction

The Finnifty price reflects the current value of the Nifty Financial Services Index, an index that tracks the financial sector of India’s economy. This index includes the major players in the financial services sector, like banks, NBFCs (Non-Banking Financial Companies), and insurance firms. For investors, understanding the fluctuations and trends of the Finnifty price is critical, as it represents the financial backbone of the Indian market. In this guide, we’ll explore what drives the Finnifty price, how it is analyzed, and why it’s an essential indicator for financial market enthusiasts.

What Determines the Finnifty Price?

Several factors influence the Finnifty price, making it sensitive to market dynamics and economic policies. Primarily, changes in the interest rates, inflation rates, and overall economic health significantly impact the financial services sector. Government policies and RBI decisions on banking regulations, credit growth, and financial reforms can also sway the Finnifty price. Understanding these factors helps traders make informed predictions and align their investment strategies accordingly. For instance, favorable economic policies might boost the financial sector’s performance, pushing up the Finnifty price.

Importance of Monitoring Finnifty Price for Investors

For investors, keeping an eye on the Finnifty price is essential for several reasons. This index provides insights into the health of India’s financial sector and reflects the performance of significant companies within it. Investors interested in sectors like banking, insurance, and financial services often use Finnifty as a benchmark. Additionally, tracking the Finnifty price can reveal trends and potential opportunities, especially for those involved in day trading or short-term investments. Understanding Finnifty’s movement is vital for gauging market sentiment and adjusting portfolios accordingly.

How to Track Real-Time Finnifty Price?

Tracking the real-time Finnifty price is convenient, thanks to various online platforms and mobile applications. Websites such as the National Stock Exchange (NSE) and financial news portals provide live updates on the index’s performance. Mobile apps, especially those from brokers and financial service providers, allow traders to set price alerts for the Finnifty price. Having access to real-time data helps investors make timely decisions, especially during volatile market conditions. Regular monitoring is crucial for anyone involved in active trading or considering investments in financial sector funds.

Analyzing Finnifty Price Trends

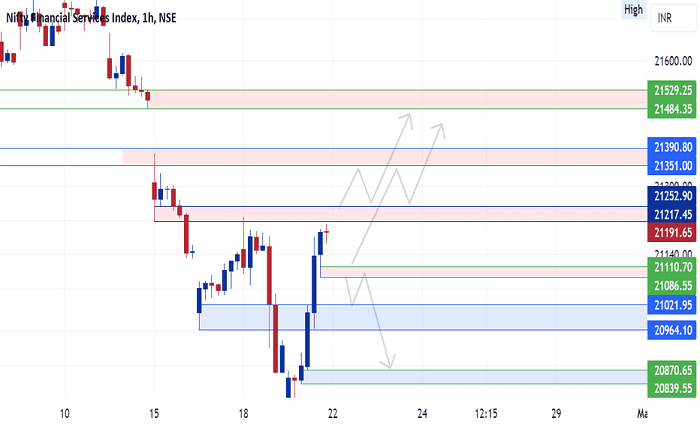

Analyzing Finnifty price trends involves understanding historical data and identifying patterns that may recur. Tools like moving averages, trend lines, and support-resistance levels can provide insights into the index’s potential direction. Technical analysis is often applied to the Finnifty price to predict short-term movements, while fundamental analysis examines broader economic indicators and their impact on the index. By combining both analyses, investors can make more informed predictions about Finnifty price fluctuations, optimizing their trading strategies to align with market trends.

Impact of Economic Policies on Finnifty Price

The Finnifty price is highly sensitive to economic policies and decisions made by authorities like the Reserve Bank of India (RBI). Monetary policies, including interest rate adjustments, can directly impact banks and financial institutions, influencing the Finnifty price. A reduction in interest rates, for instance, often leads to increased credit growth, benefiting the financial sector. Similarly, reforms in banking and financial services regulations can enhance or restrict sectoral growth, affecting the index’s value. Investors must stay updated on policy changes to anticipate potential impacts on the Finnifty price.

Role of Major Companies in Influencing Finnifty Price

The Finnifty price is shaped by the performance of its constituent companies, which include some of India’s leading financial institutions. Companies such as HDFC Bank, ICICI Bank, and Bajaj Finance are major players within the Finnifty index. The financial health, profitability, and market performance of these corporations heavily impact the Finnifty price. When these companies report strong quarterly earnings or announce expansions, the Finnifty price is likely to rise. Investors often track these companies’ performances to anticipate the index’s direction and make informed investment choices.

How to Invest in Finnifty-Based Instruments?

Investing in Finnifty price-linked instruments offers opportunities for those who want exposure to India’s financial sector. Exchange-Traded Funds (ETFs) and index funds based on Finnifty allow investors to gain diversified exposure to the financial services industry without investing in individual stocks. Additionally, derivative products like Finnifty options and futures provide a way for investors to speculate or hedge on the index’s movement. These products are accessible through brokerage platforms, making it easy for investors to incorporate Finnifty into their portfolios. Understanding the Finnifty price movement is key to maximizing returns in these investments.

Tips for Trading Finnifty Price Volatility

Trading on Finnifty price volatility can be profitable but requires a strategic approach. Key strategies include monitoring economic events, using technical indicators to identify entry and exit points, and setting stop-loss orders to manage risk. Since the financial sector can be sensitive to macroeconomic changes, traders often stay updated with news that could impact the sector, such as RBI policy changes or quarterly earnings reports. Successful Finnifty trading requires agility, a clear understanding of market sentiment, and the ability to respond to price fluctuations promptly.

Finnifty Price Predictions: What Experts Say

Expert predictions on the Finnifty price often take into account macroeconomic trends, interest rate forecasts, and sectoral performance. Analysts use various models to forecast the index’s future direction, considering historical data and economic projections. While predictions can be helpful, they are not guarantees. Investors are advised to use expert insights as one of many tools in their analysis, combining predictions with personal research. Given the unpredictable nature of markets, having a diversified approach to investing in Finnifty can help manage potential risks.

Conclusion

In conclusion, the Finnifty price is a significant indicator for anyone involved in India’s financial markets. It reflects the collective performance of major financial institutions and is influenced by a variety of factors, including economic policies, company earnings, and global market trends. By understanding and monitoring Finnifty price movements, investors can make informed decisions, whether they are involved in short-term trading or long-term investments in the financial sector. Staying updated on the Finnifty price can provide insights into market health, helping investors navigate opportunities and risks effectively.

FAQs

Q1. What is Finnifty price?

A1. The Finnifty price represents the value of the Nifty Financial Services Index, reflecting the performance of India’s financial sector.

Q2. How is Finnifty price calculated?

A2. The Finnifty price is calculated based on the market capitalization of its constituent companies in the financial sector.

Q3. What affects the Finnifty price the most?

A3. Economic policies, interest rate changes, and the performance of key financial companies are primary factors affecting the Finnifty price.

Q4. Can beginners invest in Finnifty-based instruments?

A4. Yes, beginners can invest in Finnifty-based ETFs and index funds, providing exposure to the financial sector without extensive knowledge.

Q5. Is trading Finnifty price volatile?

A5. Yes, Finnifty price can be volatile due to its sensitivity to macroeconomic changes and sector-specific events, making it a high-risk, high-reward investment.